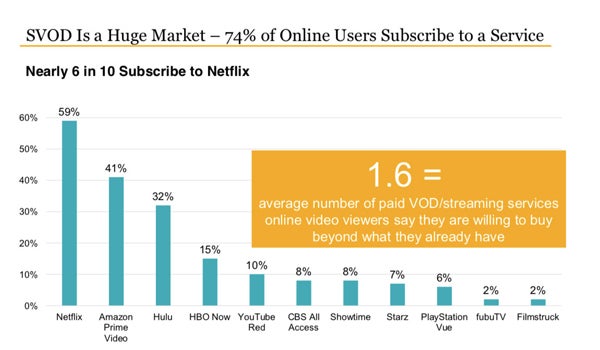

Even though three-quarters of consumers already use a subscription video-on-demand (SVOD) service, they are open to adding more – for the right content.

Viewers are willing to add an average of 1.6 more SVOD services to their current lineup, according to the 2019 Manatt, Vorhaus Digital Strategy Study. Since Disney, WarnerMedia, NBCUniversal, Apple and Discovery are all launching streaming services in 2020, the competition will be fierce, with the key to winning new subscribers being unique content.

The top three draws for a new SVOD service all centered on exclusive content. Half of people said they joined for a specific movie or TV series, 43% cited an original series, and one-third signed up because of the general theme of the content offered, such as anime, sports or nature.

“We are going to get to the point where [services] are going to start cannibalizing each other, and I think Netflix will remain No. 1,” said Mike Vorhaus, CEO of Vorhaus Advisors, the market research consultancy that ran the study.

Netflix’s dominance was stark in the report. Almost six in 10 people subscribe to Netflix, followed by four in 10 for Amazon Prime Video and about three in 10 for Hulu. HBO Now (15%), YouTube Red (10%) and CBS All Access (8%) followed.

Cord cutters may provide a funnel of new customers. Forty-four percent of people who planned to cut the cord in the next year said they would replace their cable subscription with SVOD services.

‘Screen agnostic’ younger viewers don’t care about big screens

As viewers stream more video, they’re less tied to streaming that video on a TV screen. Instead, they’ll choose the screen that’s most convenient.

“[Younger viewers] don’t care about the size of the screen. It’s really about the convenience and access,” said Ned Sherman, partner and director of Manatt Digital, the legal and consulting firm that commissioned the research.

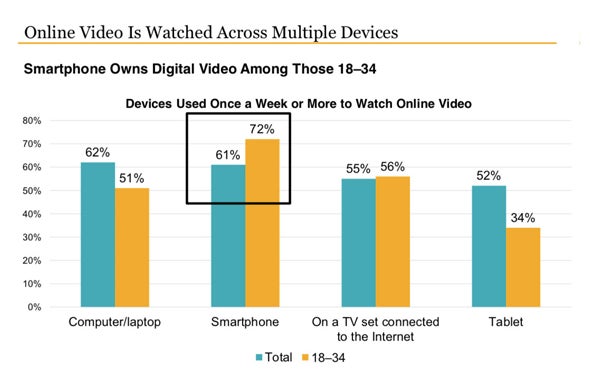

Half of all adults and two-thirds of those aged 18-34 watch streaming video daily. No matter the age, about half watch on their TV every week, but they differ in their preferences for other devices.

Younger viewers (aged 18-34) consume far less digital video on a tablet or a computer compared to the group overall, and significantly more content on their smartphone. But both groups watch roughly the same amount of digital video on TV each week.

Since screen size matters little to younger viewers, the tablet is going the way of the dinosaur, Vorhaus said.

“I did not expect to see the decay of the tablet by the smartphone as quickly [as we saw],” he said.

TV remains the leading entertainment platform for all viewers, but again, there are nuances by age group.

Forty-three percent of all adults name TV as their primary entertainment medium, but only 19% of adults 18 to 34 say the same. Adults 18-34 are more likely to say that their smartphone, laptop or video game console is their primary form of entertainment.

Esports loves ads

The report also revealed how quickly one niche corner of the streaming ecosystem is expanding: esports.

Never heard of esports? You’re not alone: Four in 10 people surveyed didn’t know what esports was, and only half of those who did have actually watched gaming streams.

But the niche community is growing. Twelve percent of people who knew about esports watch several times a week, and the other 10% do so weekly. And more than 40% plan to watch more streams in the next six months.

Half of people who watch esports choose free content with ads – the Twitch, YouTube or network TV model. Another 28% prefer an ad-free subscription fee, and 18% like pay-per-view.

Twitch is the No. 5 platform used for livestreaming, at 22%, behind Facebook Live, YouTube Live, Instagram and Twitter, which is impressive given that it primarily streams video games, Vorhaus said.

As esports picks up, the biggest leagues – think Overwatch, League of Legends, Call of Duty and Fortnite – will try to stream directly to consumers and eliminate distribution services to better monetize their audience, Vorhaus predicted. It’s similar to how both digital media companies and broadcasters are going direct-to-consumer (DTC).

But the trend is unlikely to be widespread. “I don’t know if the NFL model will ever happen,” Vorhaus said, where the content owner can demand high prices for distribution rights.

The problem? Going DTC creates too much fragmentation for viewers – the same problem faced by programmers and the consumers they’re trying to reach as a flurry of SVOD services enter the ring next year.

Follow Sarah Sluis (@SarahSluis) and AdExchanger (@adexchanger) on Twitter.