The Knot’s audience is engaged – literally.

The Knot’s audience is engaged – literally.

Eight out of 10 couples in the US – around 12 million monthly uniques – visit the wedding planning site for advice while getting ready for the big day.

But The Knot has transformed itself over the last three years from an online publication to what Mike Steib, CEO and president of its parent company, XO Group, referred to as a “content-driven mobile-first marketplace.” In other words, a way to connect in-market couples with local wedding pros – and mobile has been the key.

But The Knot has transformed itself over the last three years from an online publication to what Mike Steib, CEO and president of its parent company, XO Group, referred to as a “content-driven mobile-first marketplace.” In other words, a way to connect in-market couples with local wedding pros – and mobile has been the key.

Steib made mobile into a top priority when he took the reins at XO in 2013.

“Our company had primarily served our customers in the way that media companies usually do, with content and community,” Steib said. “But the customers we’re serving today have dramatically different expectations than the customers we were serving a few years ago.”

The primary expectation is immediacy. Rather than reading an article about when and how to choose the right wedding venue, why not provide visitors with advice about selecting the right venue coupled with the ability to book a tour right then and there?

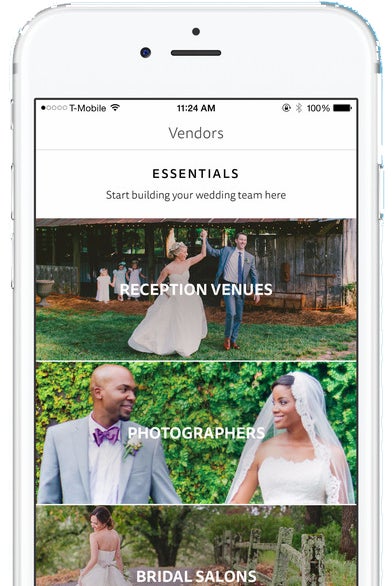

Today, The Knot has a suite of three apps to aid in the wedding planning, booking and buying process: one to connect users with a network of more than 300,000 local vendors across the US, like photographers, florists and DJs; a guest list manager; and another that serves as a mobile database of more than 15,000 dresses and bridal accessories.

“We rewrote virtually every stitch of code from scratch and rebuilt every app and website with a specific and different purpose in mind,” said Steib. “Basically, we replatformed the entire company and reorganized ourselves around product. You won’t find many publishers that make most of their money on advertising, as we do, that have more than one-third of their headcount dedicated to product and engineering.”

Today, around 77% of couples access The Knot via their smartphones, while more than 58% browse gowns on a mobile device.

According to Localytics, the average 60-day retention rate is 31% for media and entertainment and 24% for ecommerce and retail apps. The Knot’s main wedding planner app still retains an average of 50% of its users after two months.

It wasn’t always smooth sailing, though.

When Steib announced his intention to transition XO Group from a digital publisher to a technology-focused company – it was on his first earnings call as CEO and the press release about his appointment had only hit the wires a few minutes before the call – investors balked and the stock immediately dipped 20%.

“That happened because we were a slow-growth company with decent cash flow and we’d attracted an investment base to match,” Steib said.

But his bet is paying off. XO’s stock is up approximately 85% since The Knot began rearchitecting its offering, and transactions revenue for the second quarter of 2016 was up 55% year over year.

The Knot’s evolution also helped galvanize its national ads business with big brand partners like Disney, Tiffany’s and Best Buy.

The Knot’s evolution also helped galvanize its national ads business with big brand partners like Disney, Tiffany’s and Best Buy.

“In 2011/2012, that business was roughly flat, but it’s been growing at a 15% compound annual growth rate because we’re giving more engaged audiences and better brand adjacencies to our advertising partners.”

The Knot is also doing more business with the local wedding vendors that populate its planning app, everything from beauty salons and bands to caterers and calligraphers. More engagement means more leads and more customers coming through the door looking to book their services. Vendors only pay when a user executes a transaction.

“Part of the reason we made the investments that we made here is to serve the entire user funnel more efficiently,” Steib said.

The wedding planning funnel also generates a treasure trove of customer data.

In addition to its apps and site, The Knot operates a free wedding website builder and a registry service. Users tell The Knot when their wedding is, who’s invited, which vendors they’ve booked and which they still need, how much budget they have to spend, how they want to allocate it by category – and hundreds of other data points along the way.

“They’re telling us about themselves, and they’re telling us what they have and what they still need to do,” Steib said. “We used to be a media property. Now we’re a personalized suite of software for managing every step of the wedding planning process.”

This is the third installment of Home Screen, a series of profiles on mobile pubs and apps and the devs that make them (and hopefully make money on them). Read about home décor app Lux, teen voting app Wishbone, lip-syncing app Musical.ly, pop culture magazine Movie Pilot, news app News Republic, on-demand laundry app Cleanly, music streaming app LaMusica, P2P global shopping app Grabr and kid-friendly chat app Jet.me, driving app Dash, anonymous app Whisper, storytelling app Episode, weather app Poncho, online writing community Wattpad and sticker app Emogi.