![]() “Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Nico Neumann, senior research analyst for programmatic marketing strategy and analytics, University of South Australia.

Transparency in media buying continues to be a widely discussed topic. The second part of the ANA report was released last month, and we also heard more about apparent consequences of client-agency relationships. JPMorgan Chase, for example, decided to audit its agency, while allegations of misleading and dishonest conduct led to a lawsuit between Ikon Communications and an Australian client.

Clearly, the debate has moved from exploring widespread practices to the blame game: Which factors or parties are responsible for any potentially unethical behavior and the resulting mistrust?

Declining Client Fees

Several industry experts point to clients’ procurement teams and declining fees as the reasons for agencies being forced to find additional income. Agency fees fell annually by an average of about 2.3%, while workloads increased simultaneously, according to Michael Farmer, author of “Madison Avenue Manslaughter.” Both trends result in a compound decline in prices of 4.5% per year (see Figure 1).

Record Agency Profits

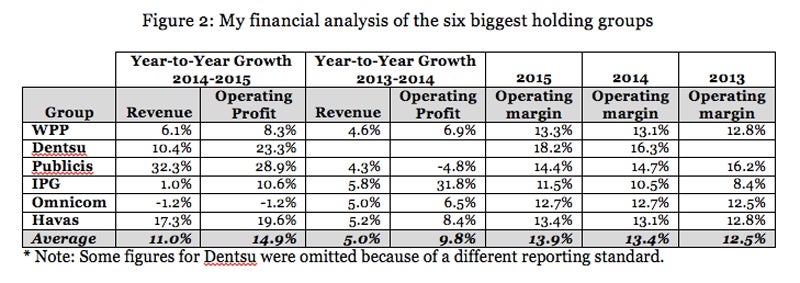

However, this is only one side of the story. Despite declining client fees, large agencies seem to do really well. When analyzing the annual reports of the six big holding companies – WPP, Dentsu, Omnicom, Publicis, IPG and Havas – I found that both revenues and operating profits have grown over the last few years (see Figure 2).

That means agency groups bring in more dollars in total and managed to pocket a higher proportion of each dollar. The average operating margin across the six companies has grown from 12.5% in 2013 to 13.9% in 2015. Furthermore, many agency stock prices have reached new highs in 2016.

Now one is left to wonder: Can we blame procurement teams for pushing prices down if they read headlines about fantastic agency performances?

Given the record-breaking profits and stock returns, the cost-cutting pressure from procurement teams is likely to grow, thereby driving agencies again to find additional income. It’s a vicious circle that needs to be broken.

The Gap Between Lower Fees And Higher Profits

The other issue worth considering is the source of the latest wealth: If client fees go down and agency profits up, where is this money coming from?

Do large agencies pass the increased pressure on to their clients – the media owners, broadcast networks and publishers – by demanding mandatory add-on services, such as hiring the agency for research in exchange for media buys, or by asking for more discounts, which may not be given back to the client?

If we believe the ANA transparency report and anecdotal evidence, such murky types of revenue generation are at least partly responsible for the increasing profits.

Nevertheless, such huge gains in earnings cannot be based entirely on possible kickbacks and hidden arbitrage. It’s no secret that agency groups have diversified into other lucrative parts of the marketing value chain, offering specialized digital services, analytics, research and programmatic and technology support.

Yet these revenue streams open up additional cans of worms. In particular, there is a massive conflict of interest if the same company does the media planning, execution and the final auditing, in the form of attribution or marketing-mix modeling, to determine which channel has been efficient. In such cases, a client will always be plagued by the concern that an advocated channel or publisher is only chosen because the agency makes money with it.

This is like a doctor who prescribes medicine that is only distributed by his sister. Using the same group’s analytics team would then be like asking the doctor’s brother to investigate whether the prescribed product was chosen correctly.

Sustainable Business Model Needed

Looking at all the recent developments, it stands to reason that the old business model of the holding groups is not sustainable. No agency can rely forever on any possible hidden income – such as undisclosed discounts or questionable mark-ups – to compensate for reduced revenues in other areas.

Likewise, media agencies need to stop using low-priced media planning accounts as a door opener to cross-sell their more profitable services. This can create mistrust because of conflicting goals – saving money for the client versus making money for the agency, for example. It is simply impossible to be neutral agent, media owner and auditor at the same time.

To avoid such situations, a holding group’s specialist services, including trading desks, analytics and search engine optimization, should only be offered separately on the market and not as a bundled add-on product to subsidize other agency units. This also means that clients should carefully check their contracts and refuse any clauses that force them to source extra services beyond media buying strictly through the group’s network.

From a strategic perspective, agencies are probably well advised to position themselves as niche experts who are hired for complex services for which they deserve to be compensated accordingly. Such a business transformation will also require a shift in the service mindset: Account directors and salespeople must learn to say no to client requests that are unreasonable or were not part of the original brief (unless they are paid for separately). Even if this means walking away from a major brand to protect one’s employees and reputation, as WPP recently did involving a pitch with supposedly irrational demands.

In the long run, this is the only way agencies will be able to maintain their credibility and compete successfully with management consultancies, which are pushing into the media business and have a strong performance-driven approach.

Follow the University of South Australia (@UniversitySA) and AdExchanger (@adexchanger) on Twitter.