Publicis Groupe will acquire 20% of Matomy Media Group, an Israeli performance marketing company that recently went public on the London Stock Exchange, the companies said Monday.

Publicis Groupe will acquire 20% of Matomy Media Group, an Israeli performance marketing company that recently went public on the London Stock Exchange, the companies said Monday.

The investment will not generate cash for the company’s coffers, going instead to a small group of individual investors, but CEO Ofer Druker said it will result in collaboration between Matomy and Publicis-owned agencies.

Under the deal terms, Publicis will invest about $60 million to snap up 17.9 million shares of Matomy stock from a small group of individual investors that includes Druker and Chairman Ilan Shiloah. The agreement comes with an option to buy another 4.9% worth of Matomy shares.

“Publicis will be able to work with us on three main elements,” Druker told AdExchanger. “One will be to include us whenever it makes sense in their media-buying activities. The second is Matomy is planning to grow to more territories; next will be Asia and Eastern Europe. Publicis has a strong ability to help us start building our presence there.”

Third, he said Publicis will aid Matomy’s efforts to diversify to new industry verticals such as “fashion, ecommerce, and so on where we are still not strong.” The company’s roots are in finance, education and other performance-obsessed categories.

The deal follows an uptick in advertising technology investments from WPP Group, Publicis Groupe’s chief rival. In separate deals this fall, WPP divested itself of technology and data holdings in exchange for a position in two ad platform companies.

In September it transferred ownership of its Open AdStream ad server to AppNexus in a deal that gave it a substantial 15% ownership of AppNexus. (AdExchanger story) And last week WPP took possession of 12.4% of Rentrak, in the form of $98 million worth of stock. In exchange, Rentrak received Kantar Media’s US-based TV measurement business. It’s probably too early to call it a trend, but industry observers – and startup execs in need of cash – will certainly be looking closer at the holding companies as a possible source of “liquidity.”

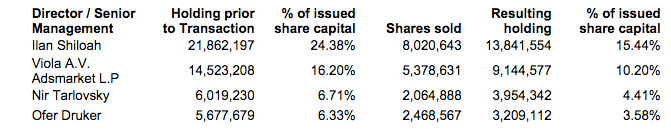

Below is a rundown of stock sales from the investor release. The usual lockup restrictions that accompany sales of stock were waived to allow the transaction.

Notably, the collective holdings of these four investors shrinks from an approximately 53% stake to 33% post-sale.

Notably, the collective holdings of these four investors shrinks from an approximately 53% stake to 33% post-sale.