This story continues our series on programmatic media in the BRIC countries (Brazil, Russia, India, China). Check out our earlier pieces on Brazil and Russia. The final installation, on China, will publish in the coming weeks.

This story continues our series on programmatic media in the BRIC countries (Brazil, Russia, India, China). Check out our earlier pieces on Brazil and Russia. The final installation, on China, will publish in the coming weeks.

India’s growing Internet population would seem to make it a prime market for RTB and programmatic buying. But the country is not necessarily an early adopter market, and so ad technology companies bringing programmatic there are investing significant resources in education.

“It’s a very early market and there is still a lot of hand-holding that we have to do,” explained Asif Ali, CEO and founder of Reduce Data, an advertising analytics and optimization platform that is transitioning into a DSP. “Advertisers are definitely excited about RTB, but I would not say they are willing to put the money into it.”

Luckily, two overall internet trends are also fueling interest in RTB: the growth in ecommerce in India and the introduction of the Facebook Exchange.

Online Advertising On the Rise

Looking at the online population, there were 73.9 million total unique online visitors in India as of June 2013, according to comScore, which is 31% year-over-year growth. In its 2013 India Digital Future in Focus report, comScore found that in terms of growth rate, this puts India second only to Brazil, which is growing rapidly in terms of RTB and programmatic.

eMarketer forecasts that, this year, India will be home to 161.6 million people who access the internet via any device, or 13.2% of the population. And this growing internet population is responding well to online ads. Fifty percent of internet users in India think online ads are informative, and 46% felt they helped them find the right product, according to research by the Internet & Mobile Association of India (IAMAI).

Online advertising is growing and expected to reach 29.38 billion rupees (approximately $439.5 million*) by the fiscal year 2013-2014, which ends March 31, 2014, according to the IAMAI. This would be a 30% increase over the 2012-2013 fiscal year, which saw 22.6 billion rupees (approximately $338 million).

“The Indian market is probably where the US was in 2007, maybe even before,” said Arun Kumar, president of Mediabrands Audience Platform, Group of 14 (MAP G14), which is part of IPG. “Certain types of clients, like the finance and travel categories or ecommerce, there is a pretty large percentage of money that goes into digital advertising, but for the rest it is probably less than 2% that goes into digital.”

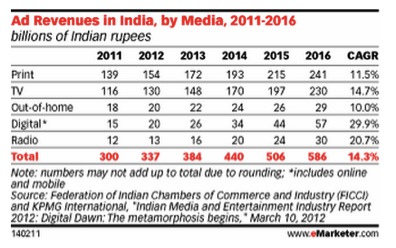

A 2012 report from the Federation of Indian Chambers of Commerce and Industry finds digital is becoming a bigger part of the overall advertising mix. By 2016, it forecasts digital ad revenues will be 57 billion rupees ($855.2 million), or 9.7% of all advertising revenues. In 2011, that percentage was 5.0%, or 15 billion rupees ($225.2 million).

“When we first started in India in 2002, we used to find that they copied the US models almost exactly, a few years behind, but now there’s a lot of innovation from the publishers and agencies,” said Roy de Souza, CEO of global ad platform ZEDO. “It’s not yet a huge market, despite the population size, but the long-term potential is very high.”

Programmatic and RTB Still in Early Stages

India is a late adopter market when it comes to programmatic buying and RTB. But now that Facebook Exchange is in the mix, and larger companies are leading the way, it is beginning to see growth.

“While RTB is relatively nascent in India, it is already growing very aggressively,” said Mahesh Narayanan, MD of Sociomantic India. “Advertisers are getting more sophisticated with their data, showing an interest in more complex applications and segmentations. They are also asking the right kind of questions to get better results.”

Gulshan Verma, chief revenue officer of local ad technology company Komli Media, told AdExchanger that he sees the RTB space doubling every six months. “It’s hard for me to put a number on it right now,” he said, “but I can tell you that the majority of impressions that we buy, that are non-social, are bought using real-time bidding.”

There are a lot of companies playing in India these days, including ZEDO, Sociomantic, and Komli Media, which built the Indian DSP ATOM for mobile and web. Asia-Pacific focused Brandscreen also runs a DSP in India, which is seeing above 10.7 billion impressions a month.

Global or US-based companies are finding fewer barriers to entry into the Indian online advertising space, with English as a widely accepted language and a tech-savvy population.

Sociomantic, Triggit, and Reduce Data, all known in the US and Europe, are moving into India, armed with experience and knowledge of programmatic. Meanwhile, global ad platform ZEDO launched the ZINC Exchange in 2011, and AdIQuity, a mobile advertising platform, debuted a mobile RTB exchange in India in 2011.

When it comes to these international companies, said Mediabrands’ Kumar, “they may not have local offices, but they are certainly starting to have inventory.”

“You don’t need to have servers inside the country,” he explained. “English is a very commonly-accepted language, so it’s not going to be that huge deal to get access to local inventory.”

Precision Match, digital marketing data provider, is another APAC-focused player, working to provide the necessary data to marketers to make the most of RTB. The company recently released a chart showcasing the main players in the digital advertising landscape in 2013.

Additionally media buyers and advertisers from the US are working in India, including Neo@Ogilvy, which partnered with DSP Brandscreen in India in 2012, and IPG, which acquired Interactive Avenues, with offices in Mumbai, Delhi and Bangalore, earlier this year.

“In the US, we’re comfortable using a lot of self-serve platforms and the network models are still the main ways of buying,” said Sean Muzzy, CEO of North American Neo@Ogilvy. “[In India,] as advertisers use a more performance marketing mindset, and as ecommerce grows, you’ll see the adoption ramp up.”

What’s Holding India Back?

All of this is increasing advertiser and buyer interest, but a lack of data, lack of education, and some publisher concerns are holding back growth, as they have in other countries.

“Traditionally, RTB was viewed as a platform to sell off remnant inventory while publishers preferred to sell their premium inventory directly,” Sociomantic’s Narayanan said. “Now, publishers see that programmatic buying actually helps them realize the true value of their inventory and hence are increasingly RTB-enabling their entire inventory.”

There is also a different mindset in India when it comes to online advertising, according to several people who spoke to AdExchanger, and as a recent ClickZ article highlighted. Therefore, many of these experienced RTB and programmatic-focused companies must educate buyers and publishers about the value and opportunity.

Reduce Data’s Ali called it a bit of “hand-holding,” but noted that the education is important: “There is still a mindset of buying impressions, so in order for these companies to be more willing to switch to RTB, they need to understand the value of targeting audiences and buying specific segments.”

What Will Fuel the Growth?

Ecommerce is a strong growth market in India, which is a good opportunity for programmatic and RTB spend. Ecommerce, including online travel, is expected to grow 33% in 2013, according to IAMAI.

Chris Zaharias, chief revenue officer of Triggit, noted that “India ecommerce has grown so much, retargeting is becoming a very important activity.”

And as time spent online increases, so does the number of ads users can be served. In its report on India, comScore found that in India, users spent an average of only 28.4 minutes on retail sites in June 2013 — the lowest of the BRIC countries. This leaves room for growth.

“What is going to change the market in India pretty dramatically is not the number of people who are online, but the length of time they are online per day,” said ZEDO’s de Souza. “Once all these users have their own devices, like tablets, or the bandwidth, the usage goes up dramatically.”

Facebook is also growing on the consumer side, with 82 million users as of June 2013, and with such a well-known company introducing them to an ad exchange, some Indian companies are starting to pay attention. Verma told AdExchanger that the targeting options on Facebook are attractive to many marketers looking to target and segment their ads.

While Triggit, Sociomantic, and Komli are all plugged into FBX, Ali said Reduce Data is also trying to get a foothold in the space, as it will be a big growth area for RTB in India.

“FBX is going to become the biggest part of the RTB market because Facebook has one in four display advertising impressions,” predicted Triggit’s Zaharias.

However, “the state of it is still very early,” he added. “I would say that FBX has not yet gotten to the point where it is more than a third of programmatic buying in India. Advertisers know more about Google’s AdExchange, but now that Facebook has its own RTB exchange, Google is not number one in terms of authority.”

Mobile RTB Not Yet There

Mobile internet users are expected to reach 164.5 million by March 2015, according to IAMAI, but mobile advertising is nascent, especially as many users do not have smartphones and advertisers are struggling to figure out how to reach this audience.

“Mobile traffic is growing so fast globally that it is expected to surpass the desktop traffic in just a couple of years,” said Nilotpal Chakravarti, executive editor at IAMAI.. “Since it’s possible to capture data points such as device type, brand and model, as well as location of the user combined with the time of day, mobile advertising is emerging as the preferred performance marketing channel.”

Mediabrands’ Kumar sees how mobile advertising will eventually become a big space for RTB and programmatic, even though it isn’t there now.

“It’s going to start with the big clients, the global clients, and then it’s going to trickle down to the others,” he said. “In India, it will be mobile and display RTB together and video will be a distant third or fourth.”

Overall, advertisers are poised to take advantage of the growth in RTB, as internet usage is on the rise in India. Whether it’s on desktop or mobile, consumers are going online more and when they do, the advertising technology industry is ready to move.

“It is still a growing market,” said Komli’s Verma. “Digital is transitioning pretty quickly over here. Mobile is a challenge we’re looking at, but it’s a rising tide, which is a good place to be.”

*Calculations done using xe.com, as of August 29, 2013.