Amazon Publisher Services shot up in the rankings in the 2019 Advertiser Perceptions supply-side platform (SSP) report, emerging as a challenger to Google.

The survey evaluated 18 exchanges via a poll of 155 sales and ops staffers from sites with at least 3 million monthly uniques.

Amazon’s sell-side ad tech business rose from eighth last year to second in terms of use, right behind Google – which still has a commanding 23 point lead. Amazon grabbed the second spot in nearly every other category, from net promoter score to buying intention to brand familiarity.

“It feels like déjà vu. Amazon was in a comparable position a couple of years ago on the demand side, and now we are seeing a similar acceleration with publishers” said Kevin Mannion, chief strategy officer of Advertiser Perceptions. “Amazon rose as a challenger, and that rise affected everyone underneath.”

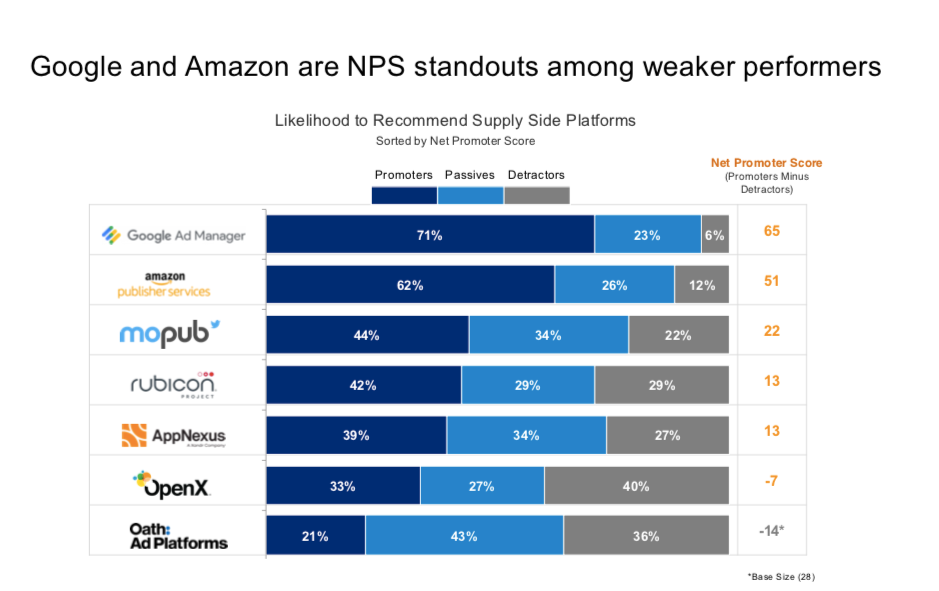

Amazon ranked second to Google in a number of categories, including its ability to monetize inventory for publishers and auction dynamics. And its net promoter averaged 51, second to Google’s 65 score.

Amazon also ranked highly in service, according to Mannion, citing 21 comments from the survey.

Google’s dominance continues

Google’s SSP still holds a commanding lead, often ranking 10 to 20 points above Amazon’s in key categories like publishers’ familiarity, use and intent to use the SSP. Its product also ranked highly in terms of monetization and analytics.

“You could argue that there is nobody competitive with [Google] on the sell side,” Mannion said.

Google ranked highly in overall performance, reporting capabilities, ease of use and its ability to root out bad ads and ad fraud.

Google also topped the rankings in the area that publishers said mattered most for their SSP partners: monetization capabilities. In comments, they also valued Google for its performance, analytics, ease of use and brand safety capabilities.

Publishers also wanted a partner with clear margins and a strong ability to take on fraud and “solve for safety,” Mannion said – another area where Google excelled.

One caveat: the poll took place early this year, before Google made its first-price auction change in March that rankled some publishers.

“Google has stepped on the accelerator and things have taken off for them in a positive way,” Mannion said. “We will see [next year] whether or not their announcement about auction policy will impact the business.”

Remaining SSPs play musical chairs

But Google and Amazon aren’t the only SSPs in town. Publishers used an average of six SSPs, and those polled said they plan to use eight or more next year.

The top ten exchanges that Advertiser Perceptions looked at, following Google and Amazon, were Xandr’s AppNexus, OpenX, Rubicon Project, MoPub, Verizon’s Oath Ad Platforms, Index Exchange, PubMatic and SpotX.

Advertiser Perceptions asked publishers not only to rank who they worked with, but who their “preferred” SSPs were. Compared to last year, OpenX and PubMatic disappeared from the top five, replaced by Amazon (in second) Rubicon Project (tied for fourth).

AppNexus, in third, remained solid in its rankings through its purchase by AT&T, rising from fourth to third in terms of use.

“AppNexus is most certainly in contention as a second choice behind Google,” Mannion said. Although some publishers might be taking a “wait and see approach” he said, “I would expect them to be a force in the year ahead.” By that time, publishers will have a clearer sense of its post-acquisition vision.

OpenX is solidly “in the middle of the pack,” Mannion said. It ranked fourth in usage and grabbed similar spots in its capabilities and buying consideration.

Rubicon, rising from seventh to fifth, has recently become more competitive, Mannion said – part of a broader comeback.

MoPub, in sixth, offers a strong solution for “mobile-first or mobile-only publishers,” he said.

Oath Ad Platforms declined as steeply as Amazon rose in this report, a reflection of turmoil and leadership change within a company no longer known at Oath. It fell from second to seventh place in use.

“Whenever you have a significant change in the way a company is going to market, you often have a period where the evaluation goes to a neutral place,” Mannion said. Oath Ad Platforms had a negative net promoter score.

Index Exchange does well in evaluations of its platform capabilities, “but they are just not seeing the consideration and intention levels others are seeing,” he said. It ranked eighth in usage as well as ninth in buying intention. But it landed in the top five for its analytics capabilities, ease of use and data capabilities.

PubMatic is “volatile,” rising and falling in the Advertiser Perceptions rankings each year, Mannion said. It ranked ninth this year in usage, down from sixth the year before.SpotX, in tenth, was the only video specialist to make the rankings.

How can SSPs rise in publishers’ perceptions? After strong tech capabilities, publishers’ second-place request was “alignment with publisher goals and needs,” according to the Advertiser Perceptions report.

The SSP report looks like a bike race: Google far in the lead, Amazon making its attack and the rest of the SSPs stuck in the peloton.

AppNexus, Rubicon, OpenX, PubMatic and Index Exchange are “clustered together in most of the metrics,” Mannion said. “They are in a more challenging position because they’re competing with two heavyweights, and Google is separating itself from the rest of the pack,” Mannion said.