The advertising industry today is largely the product of tremendous M&A activity.

The advertising industry today is largely the product of tremendous M&A activity.

AdExchanger looked at the acquisitions that made the biggest impact in the past decade.

Impact can mean many things. Some of these startups flourished under their new owners, showing worth far more than their deal price.

Others, purchased during their downfall, reflect the changing winds of ad tech and how companies that were once dominant can swiftly fall from grace.

Here are AdExchanger’s 10 game-changing ad tech exits of the decade, in chronological order. Do you agree? Leave your thoughts in the comments.

- Google buys Invite Media. Google made the first demand-side platform (DSP) acquisition of the decade by purchasing Invite Media for $81 million in 2010. Invite’s DSP capabilities gave a much-needed buy-side capability to Google and kicked off programmatic buying across the open web. During a 2010 interview with AdExchanger, VP of product Neal Mohan said his team members were “massive evangelists” about the rise of real-time bidding – and offered assurances about the product’s “openness and neutrality.” Since then, programmatic has skyrocketed – and in recent years, so have concerns over the dominance of this critical piece of the Google display stack, now known as Display & Video 360.

- Google buys Admeld. Google bought Admeld in 2011, just as the supply-side platform (SSP) space was getting off the ground. At the time, SSPs were a new category, and the Admeld deal marked a quick exit. But the SSP space would evolve many times before another exit materialized. Admeld was tightly integrated into Google AdX, making it more difficult for the competition to gain a foothold. So SSPs pushed header bidding to chip away at the “last look” at inventory AdX had. Meanwhile, many of the SSPs banking on an exit like Admeld’s never got it, and mass consolidation never happened. Only AppNexus, a dual DSP and SSP, saw itself snapped up as the independent SSP business continued through the end of the decade.

- Facebook buys Instagram. When Facebook purchased Instagram for $1 billion in 2012, it had 30 million users and no revenue. Regarded as one of the best business deals in recent memory, Facebook slowly infused the photo app with in-feed native ads, then built up a huge Stories business by replicating a popular Snapchat feature. The same back-end ad infrastructure powered a trendier, fresher social network experience. Instagram became one of the brightest growth areas of Facebook. Because of this success, Facebook opened its wallet even wider, paying $21.8 billion for WhatsApp and $2 billion for Oculus in 2014. Adding to its importance, Instagram has kept Facebook’s revenue growing amidst privacy scandals and a flattening of attention on its namesake network.

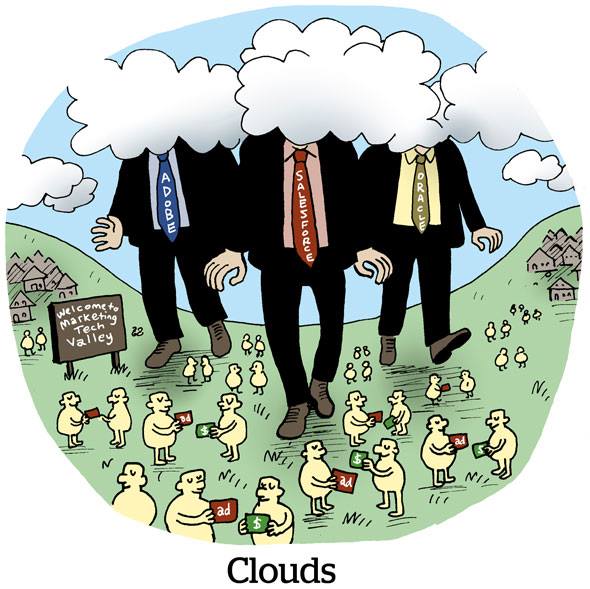

- Oracle buys BlueKai. Oracle bought BlueKai for $350 million to $400 million in 2014, proving the data-management platform space had truly arrived. The deal was sandwiched between Adobe’s acquisition of Demdex three years prior, and followed by Salesforce buying Krux for $700 million in 2016. BlueKai showed that mar tech could buy ad tech, a proof point in a longstanding thesis that the

two areas would move closer together in the future. While BlueKai’s business lives on, its sunset may be ahead. When Oracle Data Cloud, which housed BlueKai, reorganized this fall, it focused fewer resources around third-party data and more toward the future it sees in contextual data.

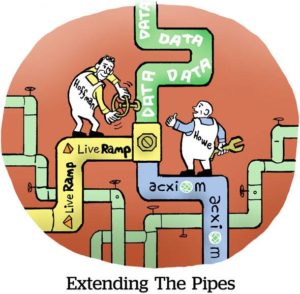

two areas would move closer together in the future. While BlueKai’s business lives on, its sunset may be ahead. When Oracle Data Cloud, which housed BlueKai, reorganized this fall, it focused fewer resources around third-party data and more toward the future it sees in contextual data. - Acxiom buys LiveRamp. LiveRamp was already the go-to data onboarder when Acxiom bought it in 2014 for $310 million. In the years post-acquisition, LiveRamp aggressively acquired would-be competitors such as Arbor and Circulate, built out its own data marketplace and established itself in new areas, including connected TV. In 2018, Acxiom focused solely on its serendipitous acquisition. It sold its legacy data marketing business to IPG, and LiveRamp became a public company, worth more than $3 billion, during a time when companies that integrate data are a particularly hot commodity.

- Verizon buys AOL and Yahoo. The fate of AOL and Yahoo hung like a question mark over the decade. When Verizon bought AOL for $4.4 billion in 2015 and Yahoo for $4.48 billion in 2016, the ad industry expected an infusion of Verizon subscriber data to revive AOL and Yahoo. But the data never materialized. New CEO Hans Vestberg made it clear its top priority was expanding its 5G network.

Meanwhile, Verizon’s other media initiatives flopped. Its video network, Go90, became a $654 million failure. Oath became Verizon Media, sold off Tumblr for a pittance and is said to be looking for a buyer for HuffPost.

Meanwhile, Verizon’s other media initiatives flopped. Its video network, Go90, became a $654 million failure. Oath became Verizon Media, sold off Tumblr for a pittance and is said to be looking for a buyer for HuffPost. - The Trade Desk goes public. Ad tech brands haven’t had the best luck when they’ve gone public. But from the moment The Trade Desk went public in 2016, it’s bucked that trend. In three years, its market cap skyrocketed from $1 billion to $11.5 billion. With an agency-focused strategy that avoided conflict, a recent push into TV and a margin-boosting focus on add-on services, this company has been successful with Wall Streeters and a potential answer for an ad industry rooting for an alternative to Google.

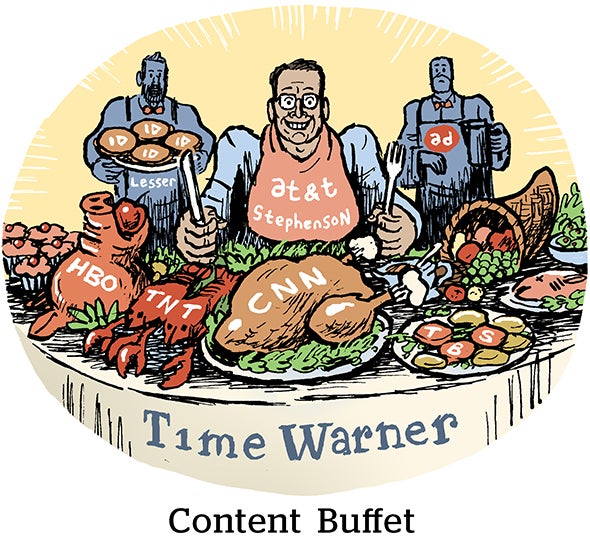

- AT&T buys WarnerMedia and AppNexus. While Verizon backed away from its telco-media ambitions, AT&T leaned in. The telco giant got content when it bought WarnerMedia for $108 billion

(including debt). And it layered on data-driven advertising when it bought AppNexus for an estimated $1.6 billion to $2 billion in 2018. AppNexus formed the basis of Xandr, the advertising unit led by programmatic innovator Brian Lesser. Two years into the acquisition, Xandr and WarnerMedia will hold their first-ever dual upfront in 2020, a sign of how closely intertwined their strategies are around selling data-infused media.

(including debt). And it layered on data-driven advertising when it bought AppNexus for an estimated $1.6 billion to $2 billion in 2018. AppNexus formed the basis of Xandr, the advertising unit led by programmatic innovator Brian Lesser. Two years into the acquisition, Xandr and WarnerMedia will hold their first-ever dual upfront in 2020, a sign of how closely intertwined their strategies are around selling data-infused media. - Amazon buys Sizmek’s ad server. Once a storied ad tech company, Sizmek collapsed at the end of the decade – but found a surprising suitor when Amazon picked up its ad server business. Similar to Facebook’s acquisition of Atlas mid-decade (which didn’t pan out), the deal pairs a rising star with a falling one. Call it an ad tech version of “A Star Is Born.” What Amazon will do with Sizmek’s ad server and dynamic-creative optimization tool remains to be seen (though we can guess), but this odd couple shows how the DNA of decades-old ad tech can live on in newer, fast-growing companies.

- Dentsu buys Merkle. Dentsu Aegis bought Merkle for $1.5 billion in 2016 in anticipation of two trends. First, it predicted the critical importance of first-party data in digital marketing. Second, it foreshadowed how agencies themselves needed data capabilities to guide their clients in its use. Two years later, IPG bought Acxiom Marketing Services, and nearly a year after that, Publicis bought Epsilon for $4.4 billion, following in the wake of Dentsu Aegis’ trendsetting acquisition.